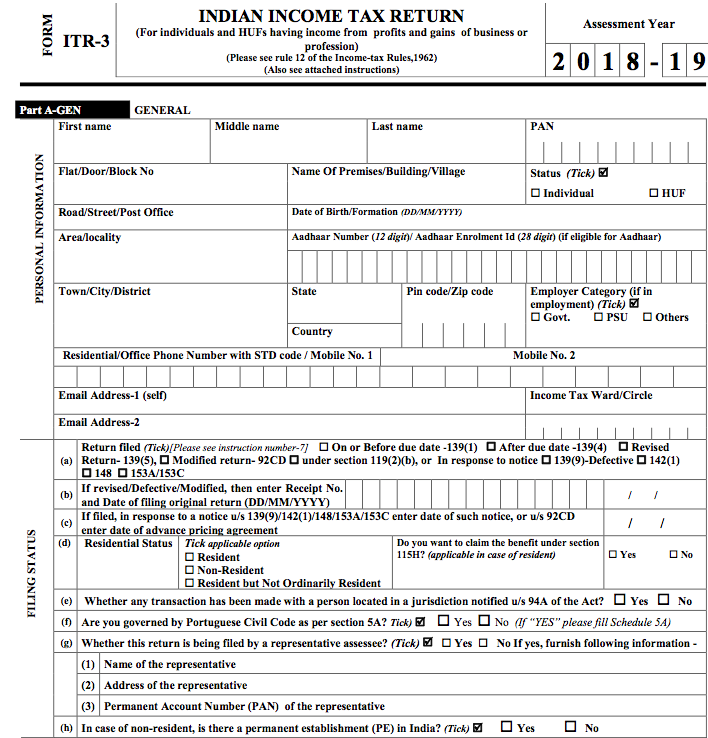

ITR-3 Return

File your business tax returns and maintain compliance seamlessly through bmentindia.com. Get a Dedicated Accountant and LEDGERS compliance platform for your business.

ITR 3 Form is applicable for the individuals and Hindu Undivided Families that earn profit and gains from business or profession.

If the individual or the Hindu undivided family is having an income as a partner of a partnership firm that is carrying out business then ITR-3 cannot be filed as in such cases the individual is required to file ITR-2.

Documents Required:

- Form 16 / Salary Slips(in case of income from salary)

- Rental Agreement(Rental Agreement, if any)

- Business Income (Proof of Business Income, if any)

- Other Sources (Proof Other Sources Income )

- Bank Statement(Bank Statement From 01.04.2022 to 31.03.2023)

- Others (Others Documents )

Available Services: