ITR-4 Return

File your business tax returns and maintain compliance seamlessly through bmentindia.com. Get a Dedicated Accountant and LEDGERS compliance platform for your business.

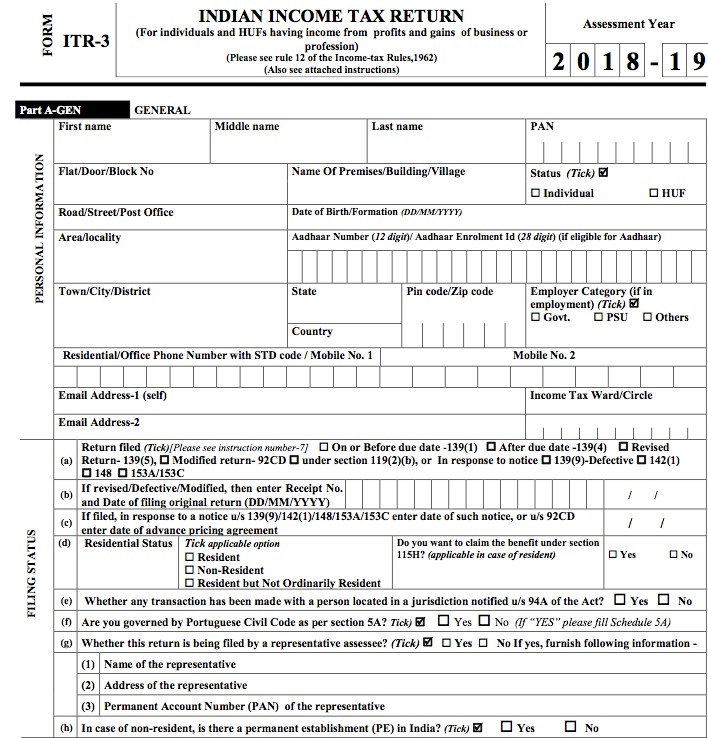

Form ITR 4 is filed by the taxpayers who have opted for the Presumptive Taxation Scheme under Section 44D, 44DA, 44AE of the Income Tax Act,1961. But this is subject to the business turnover limit i.e in case if the turnover is exceeding Rs.2 crore then the taxpayer is required to file ITR 3 Form.

Documents Required:

- TDS Certificate (Form 16 Etc)

- Business Income(proof of Business Income)

- Bank Statement (Bank Statement FY 2022-23)

- Others (Others Documents)

Available Services: